RBA Cash Rate 2022: Current Interest Rates Australia

Table of Content

This is because these smaller lenders tend to have fewer overheads to pay for and may be able to pass on these savings to customers. Whether you're a first home buyer, a long-term investor, or want to refinance, finding the best home loan rate is going to be a priority for you. But it’s important to know that there is no one “best” rate. In fact, the right home loan for your financial needs and budget may have a higher rate than others but offer additional perks, like a packaged credit card or an offset account.

The Bank of Mum and Dad is a big business in Australia, with more than half of all first home buyers getting financial help from their parents. A home loan that allows for guarantors is a great option if your parents are willing to contribute towards the deposit. When you’re deciding which home loan to go with, it’s important to consider your individual needs as a borrower. Here are some things to consider before applying for a home loan. Comparison tools, such as rate tables and calculators, may come in handy here and may be able to help you shortlist potential options for your best home loan.

Loan term

We do not require savings history but will request statements for any bank accounts you have as well as statements for any existing loans, credit/store cards and rental history. This is so we can establish your ability to manage your finances. This amount is provided for illustrative purposes only. The amount you may be eligible to borrow will be based on a full application. All applications for loans are subject to Keystart's standard credit policies and loan approval criteria, and depend on the particular circumstances and credit attributes of each applicant. Actual loan amounts approved may therefore be different to the results presented.

Like an interest rate, an APR is expressed as percentage. Unlike an interest rate, however, it includes other charges or fees to reflect the total cost of the loan. A bank incurs lower costs and deals with fewer risk factors when issuing a 15‑year mortgage as opposed to a 30‑year mortgage. As a result, a 15‑year mortgage has a lower interest rate than a 30‑year mortgage. Like an interest rate, an APR is expressed as a percentage. The Application must include the refinance of an existing home loan from another lender and be for a total loan amount of at least $500,000.

Repayment amount

This is a low deposit home loan that eligible borrowers can get with just a 2% deposit while avoiding lenders mortgage insurance. We have different rates that apply, depending on whether you are making interest only payments or principal and interest repayments. During an interest only period, your interest only payments won't reduce your loan balance. At the end of an interest only period, your repayments will increase to cover principal and interest components.

Minus the interest you just calculated from the amount you repaid. This gives you the amount that you have paid off the loan principal. This gives you the amount of interest you pay the first month.

Compare some of Australia's top home loans

Once you find the perfect combination of these three elements you are on your way to determining the best loan for you. Depending on what you need from your home loan, banks and non-bank mortgage lenders offer a range of competitive perks and features to compete in the market. Once per month , the RBA board meets to discuss whether to raise or lower the cash rate, or to keep it on hold.

When the bond matures, you get your principal back plus any interest you earn. Savings or Treasury bonds, or bonds issued by major companies. Each has different interest rates and repayment terms, with riskier bonds tending to offer higher rates.

NAB Internet Banking

In the meantime, to give you an estimate of your monthly repayments, you may use our home loan calculator. A comparison rate is another tool that may help you to better judge the cost of a home loan. Comparison rates take into consideration many of the fees a home loan lender will charge, as well as the interest rate, to calculate a “truer” cost of the mortgage. The comparison rate is based on a $150,000, 25-year home loan paying principal and interest. If you're feeling overwhelmed by all of the potential home loan options and tools to compare with, it may be worth considering reaching out to a mortgage broker. Brokers may be able to offer financial advice and assist you in the home loan process from start to finish, as well as offer broker-only interest rates not advertised by lenders.

Relationship-based ads and online behavioral advertising help us do that. We offer a wide range of loan options beyond the scope of this calculator, which is designed to provide results for the most popular loan scenarios. If you have flexible options, try lowering your purchase price, changing your down payment amount or entering a different ZIP code.

This refinance amount of $500,000 excludes refinances of existing ING loans. Loan to Value Ratio, commonly referred to as LVR is the amount of money we will lend you in comparison to the property value. The LVR is expressed as a percentage and is determined using ING's credit approval criteria. Hi, I have a mortgage of $90,000 remaining could I change to another bank with this amount. I have a variable interest rate and receive a discount of 1.12% my rate being 4.15%.

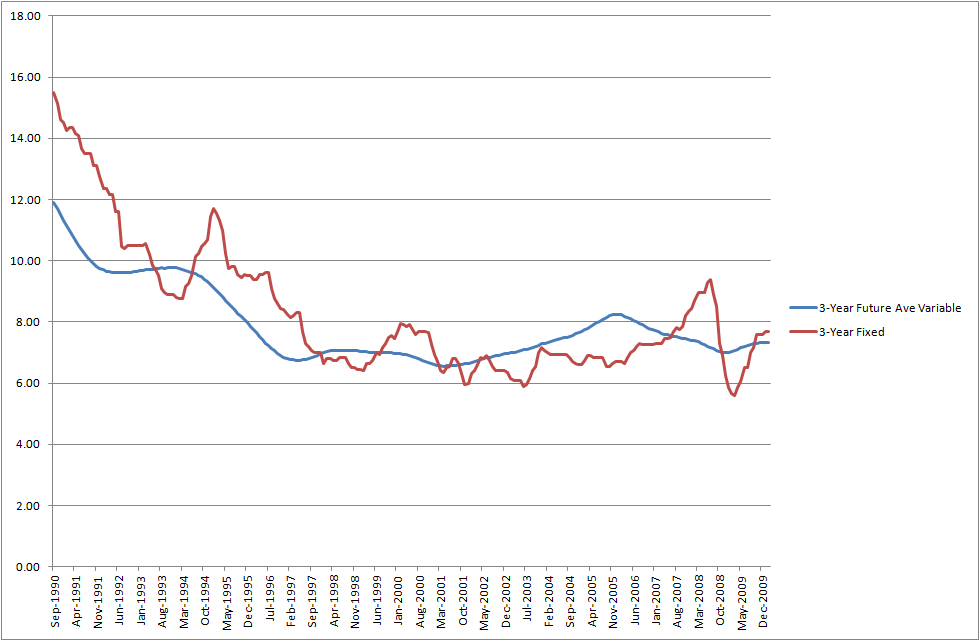

In Australia, a high RBA cash rate has historically resulted in high interest rates on home loans, car loans, personal loans, savings accounts,term deposits and so on. Likewise, a low cash rate results in low interest rates on these products, which is good for borrowers but not for savers. But what does this have to do with commercial interest rates? Simply put, the cash rate serves as a benchmark rate for savings accounts and variable rate home loans. When the RBA raises or lowers the cash rate, banks and lenders tend to modify their own home loan and deposit interest rates soon after. On the flipside, a variable rate can fluctuate based on market conditions, which means the amount of interest you pay could increase or decrease over the life of the loan.

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. We are an independent, advertising-supported comparison service. We review and compare financial products from over 200 brands from big banks and industry leaders along with smaller players, helping you find the best fit.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Brian Beers is the managing editor for the Wealth team at Bankrate. He oversees editorial coverage of banking, investing, the economy and all things money.

Comments

Post a Comment